A message from NewServerLife

If you’ve been configuring a server lately, you’ve probably noticed that DDR4 memory prices have jumped significantly. You’re not imagining it — and it’s not just us. Across the entire industry, the cost of DRAM modules has risen sharply through 2025.

At NewServerLife, we want to be transparent about what’s happening on the market so you can make informed decisions. The current price surge isn’t local or temporary — it’s part of a global trend driven by structural changes in the semiconductor industry.

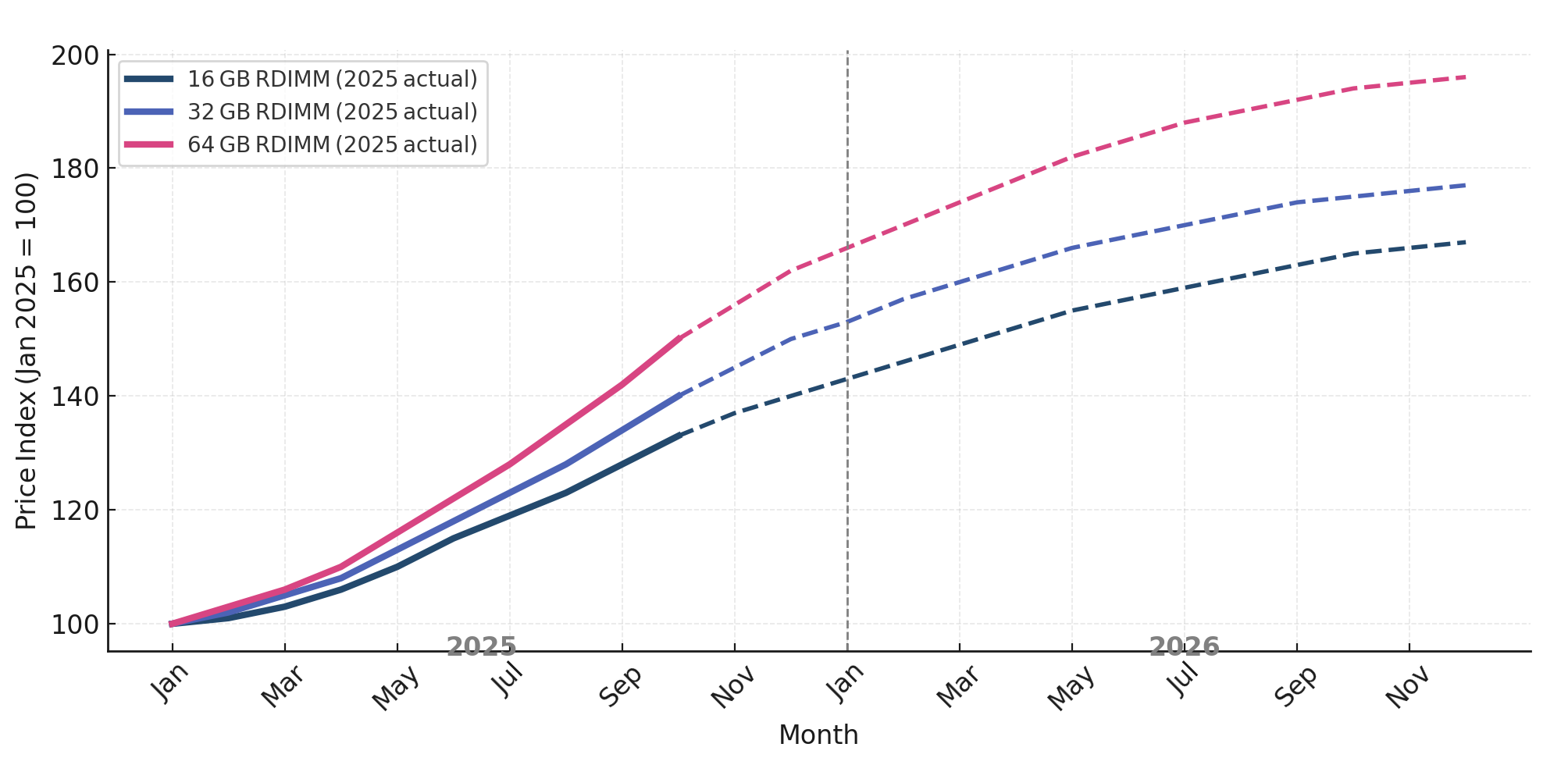

DDR4 RDIMM 2666/2933 MHz — 16 GB / 32 GB / 64 GB Modules Price Index (2025–2026 Forecast)

DDR4 prices keep rising through 2025, with no major relief expected in 2026 — a good reason to lock in current rates now.

Key takeaways

- DDR4 prices have risen 10–20% in Q4 2025 and are likely to climb further in early 2026.

- Manufacturers are moving production capacity to DDR5 and HBM memory used in AI servers.

- Supply of server-grade DDR4 RDIMM/LRDIMM is tightening across the globe.

- If you’re planning to buy a refurbished Dell 14th/15th Gen or HPE Gen10 server, it’s wiser to act now — before prices rise again.

What’s behind the DDR4 price surge

1. Manufacturers shifting capacity toward AI and DDR5

According to TrendForce, memory makers are reallocating production from DDR4 to high-margin products like HBM and DDR5, which power AI and data-center workloads. This shift leaves fewer wafers available for older DDR4 production lines, reducing supply and pushing prices up.

2. Global DRAM supply constraints

Multiple reports — including PCMag and TechSpot — confirm that manufacturers are prioritizing next-gen memory. As DDR4 becomes a “legacy” format, fewer factories are producing it, causing bottlenecks for server-grade RDIMM and LRDIMM modules.

3. AI and data-center demand

The explosion of AI infrastructure in 2024–2025 has absorbed huge volumes of DRAM and HBM. Even though these servers often use DDR5 or HBM, their deployment indirectly drives up demand (and prices) across all memory types as inventories tighten.

Tom’s Hardware reports that DRAM prices — including DDR4 — could rise by up to 45% through 2025 as AI servers “consume” global capacity.

4. Spot market volatility

By late October 2025, TrendForce noted a 9% increase in mainstream DDR4 spot trading within just a few weeks. Some distributors temporarily halted price quotes entirely — a clear signal of supply stress.

Why this affects refurbished enterprise servers

At NewServerLife, we specialize in refurbished Dell 14th & 15th Gen and HPE Gen10 servers — all built and tested with enterprise-grade DDR4 memory. These systems remain the backbone of many data centers, but the cost structure is shifting:

- DDR4 RDIMM/LRDIMM modules are getting harder to source at previous prices.

- New DDR5 servers are still expensive and not always compatible with existing infrastructure.

- Lead times for memory-dependent configurations are lengthening across global suppliers.

This means that even in the refurbished segment, final server prices are influenced by global component costs.

If you’re planning to purchase or upgrade your infrastructure, now is the best moment to act.

Our team can help you lock in pricing on refurbished Dell 14th/15th Gen or HPE Gen10 servers before further market increases — all fully tested, warrantied, and ready to deploy.

What experts forecast for 2026

TrendForce and EE Times Asia project that DRAM contract prices will rise up to 13% in Q4 2025 and remain elevated in H1 2026 as AI-related demand continues to expand.

Teguar and FusionWW also warn that no quick correction is expected: “Until manufacturers rebalance production toward legacy DRAM, the upward pressure will persist.”

In short — the industry consensus is that prices will stay high or climb further in the coming months.

What this means for our customers

- If you’ve been planning a purchase — it’s smarter to buy now.

The likelihood of DDR4 prices dropping soon is extremely low. Delaying your order may result in higher total system cost later. - We can help you lock in pricing.

Our team can reserve inventory for your build or suggest equivalent configurations that balance capacity, performance, and cost. - Future-proof with confidence.

If you’re planning for long-term deployments, we can also recommend hybrid or DDR5-ready systems — but note that even DDR5 follows the same upward trend today.

Global trend, not a local issue

This isn’t about retailer mark-ups. The entire supply chain — from Samsung and SK Hynix to component brokers — is affected. The surge is being reported by nearly every major analyst and hardware publication:

For customers, this means higher replacement costs for memory upgrades and greater urgency for planned server purchases.

Looking ahead: practical advice

- Secure configurations early. If you’re planning multiple systems, consider batch purchasing or reserving inventory.

- Let us review your configuration. Our engineers can audit your current setup and recommend optimized memory combinations — for example, adjusting densities (32 GB vs 64 GB modules) or slot layouts — to balance performance, stability, and price.

- Plan for continuity. Our engineers can help forecast component availability and pricing for upcoming projects.

Final thoughts

DDR4 prices are unlikely to return to 2024 levels anytime soon. The combination of AI-driven demand, shrinking DDR4 production, and sustained data-center growth has created a perfect storm for the memory market.

At NewServerLife, we’re doing everything we can to secure stock, stabilize pricing, and keep your options open. If you’ve been considering a server purchase or upgrade, now is the right time to act before another round of global price increases.

Lock in your configuration today — our team will help you choose the best setup and secure current pricing before market changes hit again.

Contact UsP.S.

We know rising component costs can be frustrating. The good news is that our refurbished Dell and HPE servers still deliver exceptional performance-per-dollar — backed by warranty and tested reliability.

We’ll make sure you get the best deal possible before prices move again.